For the Small Group Market (1-50)

With the release of the 2019 renewals and 2019 new group quotes, I continued to notice that the Blue Options plan was a great alternative providing premium cost savings as well as richer benefits for some groups.

Blue Options is the plan that offers two levels of benefits with Tier 1 having the richest benefits but a smaller network and Tier 2 has less rich benefits but a much larger network.

This plan is not available in all counties in Illinois. If the plan does not show on the renewal or quote, this group is in an area that does not have access to the Blue Options/Blue Choice Options network.

I noticed the following benefits with Blue Options:

- Access to both networks with premium savings

- Deductibles and Out of Pocket Maximums for both tiers cross accumulate

- The Deductible and Out of Pocket in Tier 1 was lower than their current plan

- The deductible and Out of Pocket in Tier 2 was lower or comparable to their current plan.

- The prescription coverage is applied to the Tier 1 deductible and out-of-pocket. Once the Tier 1 out-of-pocket is met, then prescription drug coverage is paid at 100%.

After reviewing my suggestion, one agent asked, “Why wouldn’t the group move to this plan?” I really couldn’t find a reason not to move.

For groups currently enrolled in a Gold PPO plan but looking for cost savings, this plan still might be an option. If the group is considering moving to a silver PPO or Blue Choice Preferred, definitely consider the Blue Options plans.

For Employees Located Out of the State of Illinois

Blue Options/Blue Choice Options plans can also be offered to employees who reside out of the state of IL. Out of state employees enrolling in an Options plan would have Tier 1 benefits if they use a provider that is in the PPO network in the state (Outside of Illinois) the services were received.

*The one exception to the above rule is found in states neighboring Illinois. Neighboring states may have providers who are not contracted with BCBS IL. In those cases, that provider would need to be in the Blue Options network in Illinois.

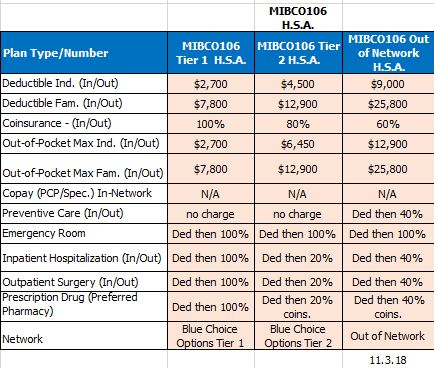

HSA Plan

Blue Options/Blue Choice Options has one HSA plan available S507OPT. For 2019, BCBS did make some benefit changes. Tier 1 deductible is $4,000/Tier two deductible is $4750. This plans compares very nicely to the silver and bronze HSA plans in the large PPO network. Any additional exposure due to the higher deductible would be offset by the large premium savings. Members could deposit those savings in their H.S.A. account and fully fund that additional exposure. If they don’t use it, they can keep it.

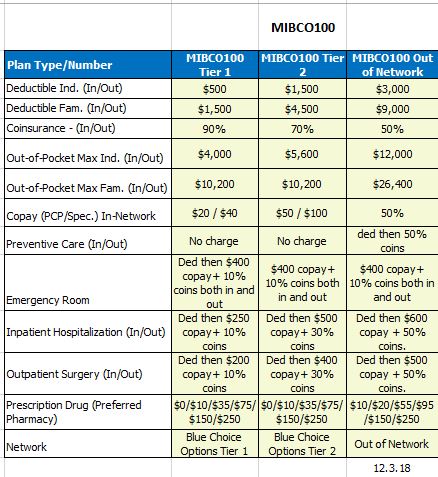

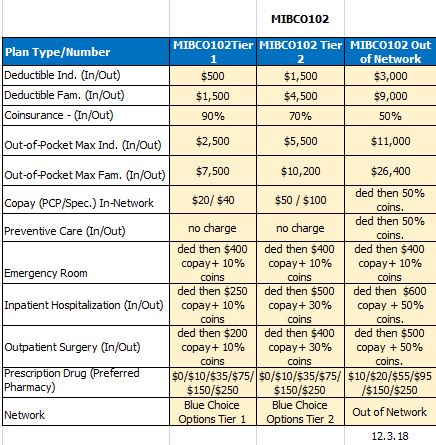

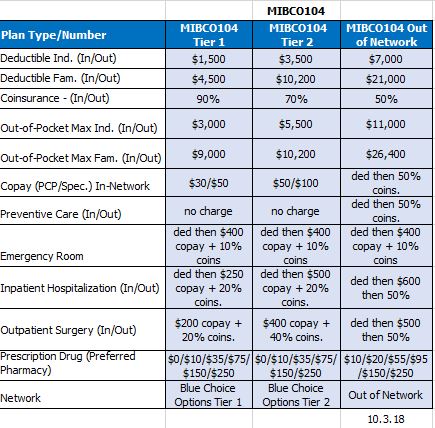

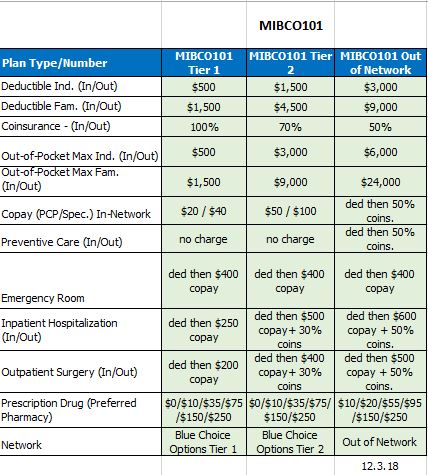

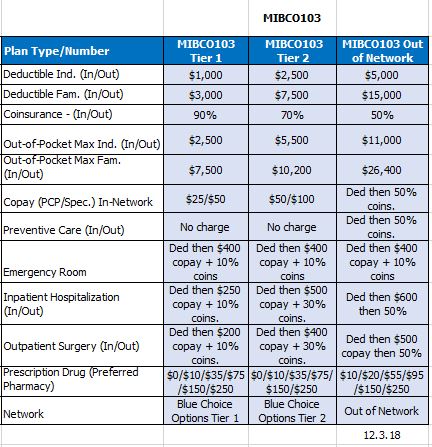

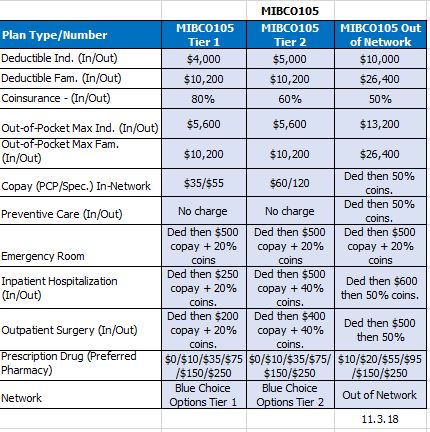

2019 Plan Benefit Comparisons

The diagrams below show the three tiers of benefits side by side. Tier 1 and Tier 2 are considered in network. Claim amounts submitted for either a Tier 1 or Tier 2 provider are applied to both Tier’s deductibles and out-of-pocket maximums.

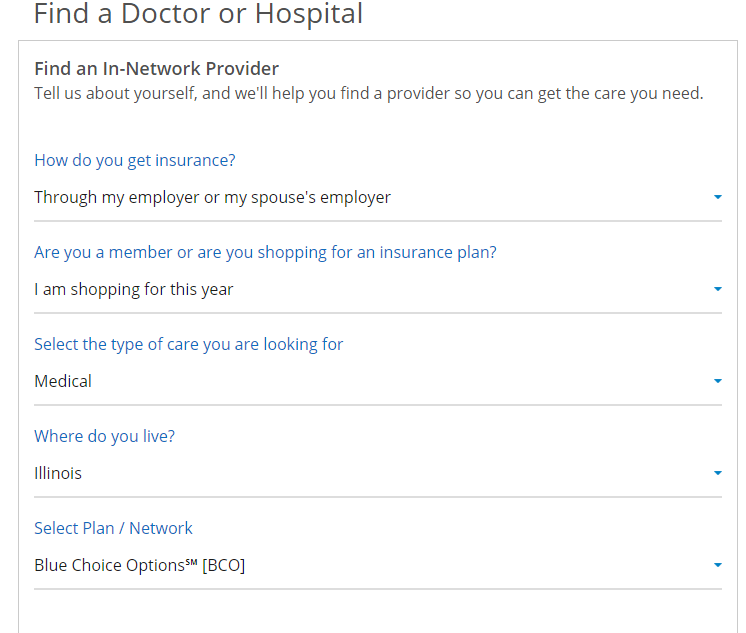

The Secret to the Blue Options Plans is How to use the BCBS IL Provider Finder:

- The Provider Finder link can be found in multiple locations throughout the BCBS IL website. bcbsil.com

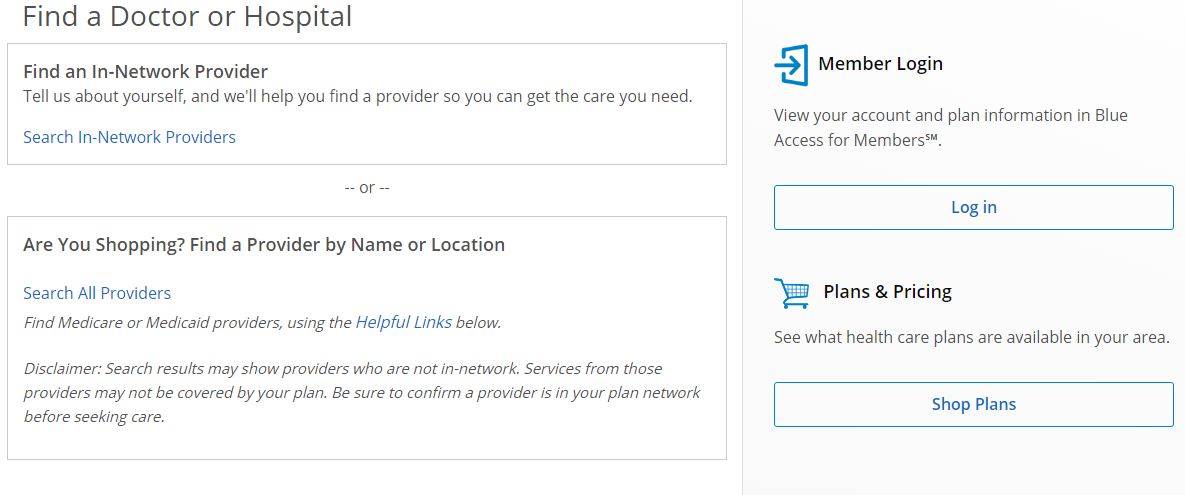

- You do not need to log into the website bcbsil.com to access the Provider Finder. Simply click on the Provider Finder tab in the light green bar or use the link below:

- On the home page of the provider finder, you can find other search options under, Helpful Links at the bottom of the page:

Helpful Links

To search for doctors and facilities, click Search In-Network Providers.

When entering a doctor or facility name, less is more unless you are certain of the spelling of the name. A zip code must be entered. When all questions have been answered, click the blue Find a Doctor or Hospital button

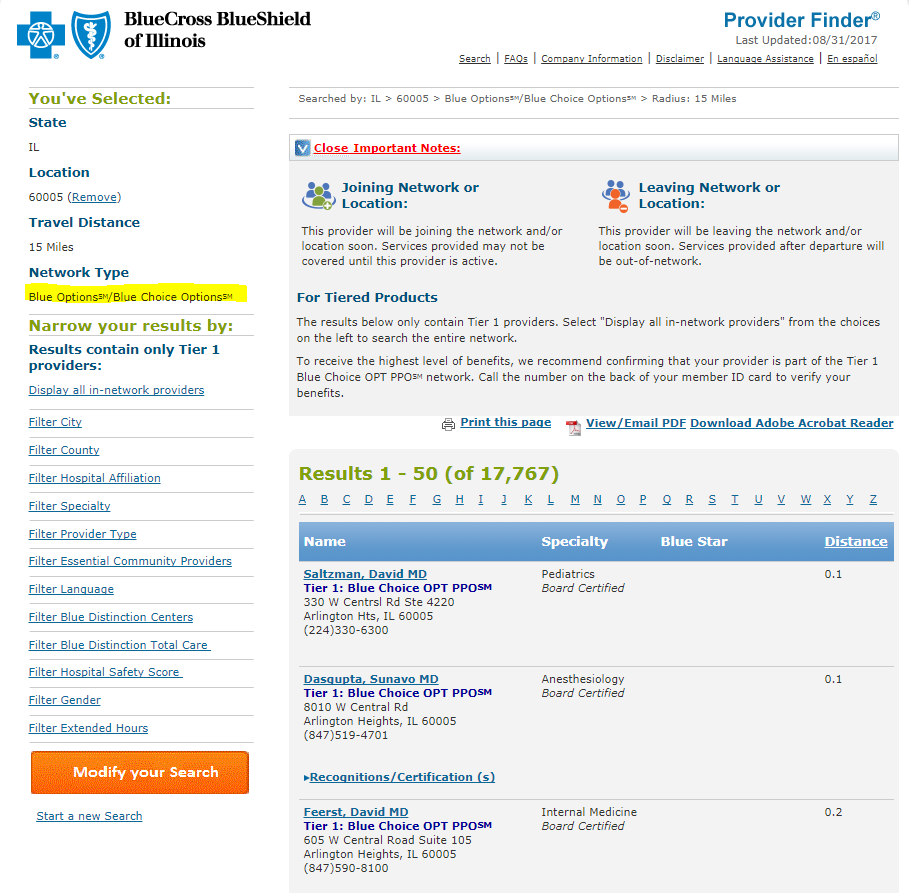

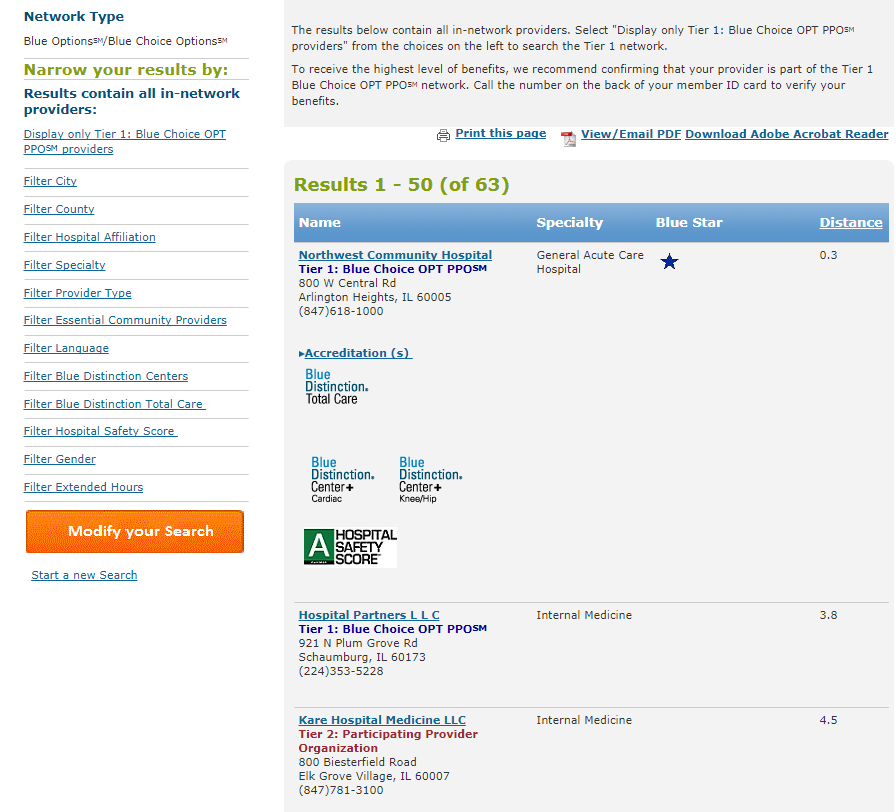

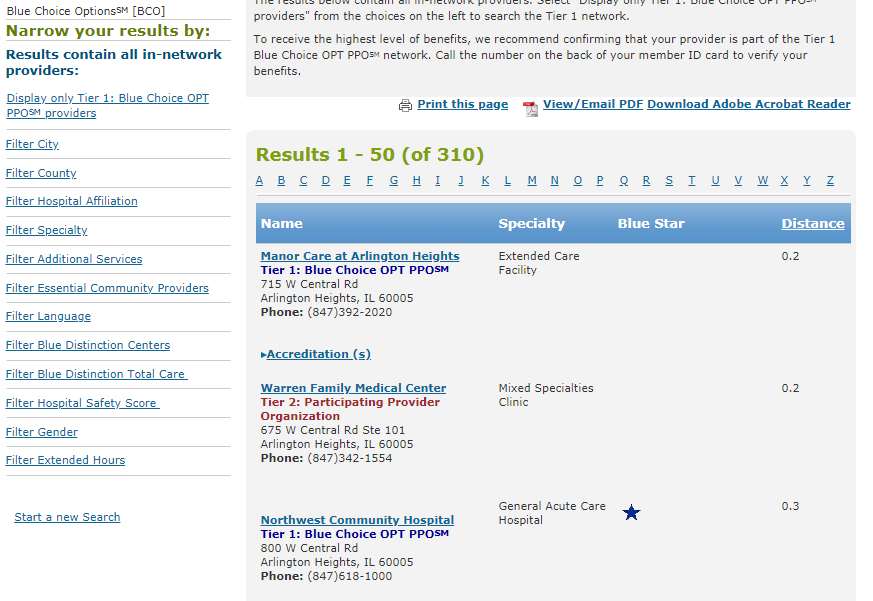

When searching the BlueOptions/BlueChoice Options [BCO] network, be aware that this network shows providers in two tiers. The initial search result will show only Tier 1 providers. You must click on Display all in-network providers under the Narrow your results by:

Any time you modify your search, you will need to click on the Display all in-network providers to show the Tier 2 providers.

When displaying all in-network providers, Tier 1 providers show their tier in dark blue font and Tier 2 appear in red font.

Blue Options/Blue Choice Options plans offer more choices for members.

Most people will be able to find a family doctor, gynecologist or pediatrician in Tier 1 which will provide the maximum benefits for their everyday medical needs. For the less frequent medical issues that may require a specialist or specific hospital, insureds will have the comfort of knowing that if they can’t find the provider that they want in Tier 1, they will have a larger pool of providers to search in Tier 2 and they still have in network benefits but at a lower level.

Personally, I try to be an educated consumer. I loved the idea of the HSA and the control I had with spending my health dollars economically. The concept of the HSA, (if I don’t spend the money, I get to keep it) fell right in line with my financial philosophy. I researched the cost of procedures at different providers to get the most cost effective care. The Blue Options plans are similar to an HSA in that the member can do the research for their providers to select the ones that allow the maximum benefits.

The HSA and Blue Options plans engage the consumer to be more involved in provider choices and more aware of how their plan works resulting in members who utilize their health plans in the most efficient ways.

I really feel that BCBS IL has offered a very creative alternative to the traditional health plans and if you are not talking about these plans, someone else will. This is a great reason to talk to your groups so that they can determine if this new plan would benefit their group.

If you still have questions about these plans, please call me at 847-631-6613 or email me at patty@midwestga.com. I would love to discuss them with you.

-Patty Kretschmar

Leave A Comment

You must be logged in to post a comment.