If you missed the last Travelers Webinar, here are some points that were discussed.

Personal Lines

How to Handle Customer’s concerns regarding increasing premiums.

Even though automobile premiums may be increasing, Travelers remains committed to mitigating the impact of industry trends with enhanced pricing, lower expenses and improved processes.

Tips for discussing these trends with your customers:

Let your clients know the current trends with auto premiums and why.

- People are buying more cars

- Distracted driving is increasing; drivers are texting and surfing the web

- Injury costs are rising

- Repair costs are rising

Review your client’s coverage to make sure all available discounts are taken.

Remind them of Travelers’ auto loyalty benefits such as incident leniency, youthful driver leniency and longevity credits which could be lost if they leave Travelers.

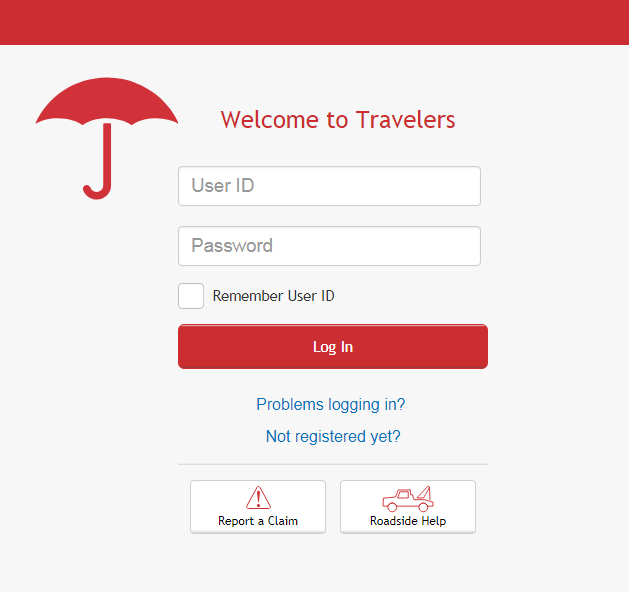

MyTravelers Website for Insureds

Travelers allows your insured’s access to their account through MyTravelers. https://www.travelers.com/Login/#/

- Report an auto, home or boat claim

- Pay your bill

- View your billing activity, payment details and policy information

- Locate a repair shop

- Enroll in one of our automatic payment plans

- Check the status of an existing claim

- View and print your auto ID card

Attract Safe Drivers with the All-New IntelliDrive Program

IntelliDrive® is a usage-based insurance (UBI) program available to customers through an easy-to-use, interactive app. New customers can receive an initial savings just for signing up.

How will IntelliDrive affect a customer’s rate?

With IntelliDrive, we measure a variety of variables related to driving, including braking, acceleration, speeding and time of day.

The higher the score, the more a customer can save at renewal. Safe drivers can save up to 20% on their auto policy, while riskier drivers could see a premium increase.

*Customers may elect to retry the program and obtain a new score.

The insured can monitor their progress and if the results are poor, they can opt out of the program to avoid any rate increase.

Travelers offers an add-on option for Premier Roadside Assistance.

space

space

Coming to Illinois in August 2018– Quantum Home 2.0

Quantum Home offers 3 easy steps to become a Home Coverage Hero.

Step 1. Scale up or down the base policy coverage

Choose your base policy coverage limits, coverage A and scale up of down Coverages B-F

For enhanced protection beyond the base limits provided by Travelers Protect, you can choose

Two other coverage levels with higher special limits: Travelers Protect Plus and Premier.

Step 2. Strengthen with an optional package the cost effectively bundles some of the most popular endorsements.

Option 1:

Additional Coverage Package

This package enhances protection in the following key areas:

- Additional Replacement Cost Protection

- Loss Assessment

- Refrigerated Property

- Special Personal Property

- Personal Property Replacement Cost Loss Settlement

- Personal Injury

Option 2:

Premier Additional Coverage Package

This package includes all the enhancements of the Additional Coverage Package, many at higher limits. It also bundles in other valuable coverages- just a few of which are highlighted below:

- Additional Replacement Cost Protection (100% of Coverage A)

- Increased Loss Assessment ($50,000)

- Increased Refrigerated Property ($5,000)

- Identity Fraud Expense Reimbursement ($25,000)

- Increased Ordinance or Law (100% of Coverage A)

Step 3. Supplement with specialty options to further tailor your client’s coverage

- Decreasing Deductible and Loss Forgiveness Package

- Roof and siding Matching Package

- Equipment breakdown coverage

- Enhanced water package

- Enhanced security package

- New additional optional coverages (you can add endorsements individually)

Quantum Home 2.0 offers more discounts help close the sale:

- NEW! Good Payer Discount of up to 15%

- NEW! Smart-Home Protective Device Discount

(for security devices that provide alerts via a mobile device)

- NEW! Water Sensor Discount

- NEW! Water Shut-Off Devices Discount

- Multi-Policy Discount of 12% on average

- Early Quote Discount of up to 10%

- Loss-Free Discount of up to 10%

- Green Home Discount

space

space

Commercial Lines

Travelers Select Monoline GL Policy

For businesses without significant assets or property, Travelers offers General Liability coverage at a competitive price.

What General Liability covers damages paid in judgements or settlements, and legal defense costs, so you are protected if you are sued or held liable for injury or damage? Specific features include:

- Premises Liability – protects if clients are injured on insured’s premises

- Products and Completed Operations Liability – protection for if your products cause bodily injury or property damage after being sold, or if work performed by you for a customer caused bodily injury or property damage.

- Personal Advertising Injury – Includes protection against liability for publication or defamatory material or copyright infringement in your advertisements.

- Liability for Damage to Premises Rented to You – protection in the event you are held liable to property damage caused to premises you rent from a third party.

Key Optional Coverages:

CyberFirst Essentials – Small Business – for data breach

Employment Practices Liability – for wrongful employment practice

Hired/Non-Owned Auto Liability – covers occasional or incidental use of a personal or rented vehicle

XTEND Endorsement – General Liability coverage enhancements include an extension of coverage to unnamed subsidiaries (other than partnerships and joint ventures) and a blanket waiver of subrogation that protects your trusted partners from our recovery of damages paid.

Umbrella – additional layer of protection up to 25 million

Business Appetite for this Coverage Type:

- Professional Services – you bring your expertise but not your stuff. You may have little or no business property to protect

- Home-Based Businesses – Operating your business from home saves the cost of office overhead

- Co-Working Spaces – business owners and professionals who lease office or conference room space on an as-needed basis from co-working spaces.

- Retailers with little or no inventory Specialty trade contractors – perform work on another’s premises with limited property of their own

Travelers is the #1 writer of Workers Compensation in Illinois

- Broad underwriting appetite

- Great desire to write monoline

- Pay as you go option with TravPay

TravPay is a pay as you go billing solution for a Travelers client’s guaranteed-cost workers compensation coverage. It allows your clients to pay their workers compensation premiums as they run their payrolls, making it easier than ever to manage cash flow. Premiums are automatically drawn from your client’s designated checking account every time payrolls are processed.

For questions contact your customer service representative:

Personal Lines: Nancy Trafford nancy@midwestga.com

Lionel Romero lionel@midwestga.com

Commercial Lines: Robin Leckner robin@midwestga.com

Leave A Comment

You must be logged in to post a comment.