For new homeowner’s policies, Encompass is using a new Enhanced Homeowners Rating system which may provide more competitive rates without changing or limiting coverage.

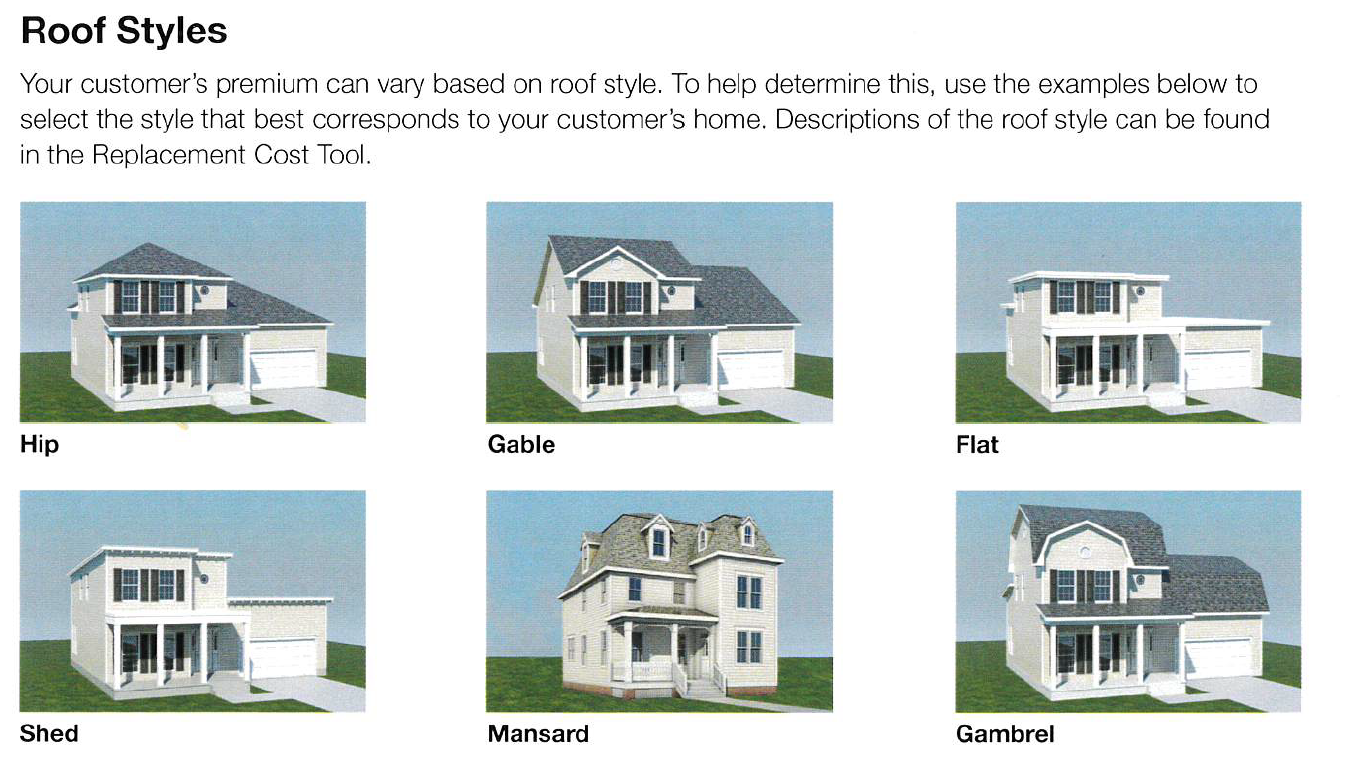

Encompass leverages a customer’s auto variables and property characteristics, including the number of stories in the home, the age of the roof, the roof style and the roof composition. Roof coverage, especially, is a critical part of Encompass Homeowners Insurance.

What to ask about the roof:

- How old is your roof

- What is your roof material

- What is your roof sytle (see below)

Encompass offers 3 levels of coverage tailored to meet your customer’s needs.

Different levels of features can be found starting with the Special Level, Deluxe Level and the richest, the Elite Level of coverage.

Features include: Property location limit

Additional living expenses reimbursed if home is uninhabitable

Water backup damage coverage

Homeowners Association extension

Jewelry and fur coverage

Brochure below.

Additional coverages available with Encompass

- Scheduled Personal Property – provides increased limits for a specific item that typically has high value and has been appraised, such as an engagement ring or fine antiques.

- Personal Property Plus – changes tangible personal property coverage from named peril to open peril coverage. This coverage is included with Elite

- Increased Coverage on Business Property – protects items you’re keeping in your home as business samples or for sale

- Identity Theft Restoration – if your identity gets stolen, this coverage can help with legal work, phone calls and lost wages

- Electronic Data Recovery – Covers up to $5,000 for recovery of lost data from computers, such as years of family photos, videos and music.

- Water Backup – helps cover damage in your home from backed up sewer/drains or broken sump pumps

- Extended Coverage on Jewelry, Watches and Furs – we automatically include coverage for loss or theft – $10,000 with Elite and $5,000 with Deluxe

- Lifestyle Endorsement – Unique combination of liability and property coverage made for the lifestyle of today’s policyholders, including coverage for family members in a resident health care facility, increased coverage for unscheduled jewelry, additional coverage for sports and hobby equipment with a low $50 deductible and more.

- Trees and Shrubs – Increases limits and expands coverage for lawns, trees, plants and shrubs

- Building Ordinance – Covers increased costs due to the enforcement of any building codes, ordinances or laws regulating construction, maintenance or demolition of your home

- Personal Umbrella Policy – Helps protect assets if someone sues over an accident and the settlement exceeds the liability limits on auto and/or home insurance.

asghasdj g

adgj;ajg a

al;kjgal g

Available Discounts:

- Policy-Loss Free (Claim-Free) – Receive a discount if you haven’t filed a property claim in a five year period

- Package Discount (Home & Auto Discount/Multi-Policy)

- Dwelling Renovations Discounts – Get a discount for work recently competed by a licensed contractor to your home’s roof, plumbing, heating/cooling and/or electrical

- Home Buyer Discount – Save on your homeowners policy if you have recently purchased a home

- Protective Device Discount – qualify for a discount if your home has additional protection against fire and theft

If you haven’t quoted your own home and auto coverage recently, submit a quote to MIBS to see how our carriers stack up with your current carrier. Click on the link below to run your own quote.

Remember, if possible quote as a package (home and auto) and include umbrella as well. Your clients need these coverages and bundling them with the same carrier gives more discount.

Incredible quest there. What happened after? Take care!

Greetings! Very useful advice within this article! It’s the little changes that produce the most important changes.

Many thanks for sharing!