The 2019 BCBS Mid-Market Portfolio will launch July 1, 2019 for effective dates starting July 1, 2019 and going forward and there are a few changes.

There are 10 new plans and six of the 2018 plans will be removed. Any group that chose a 2018 benefit plan that is being removed, will be mapped to a 2019 plan most similar to their 2018 plan upon their renewal. Included in the new plans is an H.S.A. Blue Options plan.

Plans being closed are listed below:

| 2018 Closing Plan ID | 2018 Closing Plan Name | Mapped to 2019 Plan ID | Mapped to 2019 Plan Name |

|---|---|---|---|

| MIBPP110 | BluePrint PPO 110 | MIBPP209 | BluePrint PPO 209 |

| MIBPP115 | BluePrint PPO 115 | MIBPP216 | BluePrint PPO 216 |

| MIBCS110 | Blue Choice Select PPO 110 | MIBCS209 | Blue Choice Select PPO 209 |

| MIBCS115 | Blue Choice Select PPO 115 | MIBCS216 | Blue Choice Select PPO 216 |

| MIBEE105 | BlueEdge HSA 105 | MIEEE206 | BlueEdge HSA 206 |

| MIBCO102 | Blue Choice Options 102 | MIBCO203 | Blue Options 203 |

For your new 51+ groups effective 7.1.19 or groups renewing 7.1.19 and after, be sure to use the new BPS form for any plan changes.

BCBS has changed the plan name for their HSA plans to include A for aggregate and E for embedded into the plan name in the 5th position.

Example:

-

Aggregate plans will look as follows: MIEEA###

-

Embedded plans will look as follows: MIEEE###

-

Blue Choice Options HSA compliant plans are both Embedded in 2019

BCBS’s level funded product, Blue Balance Funded for the 51+ market will be ending 7/1/2019. It will still be offered in the small group market.

Prescription Drug Changes

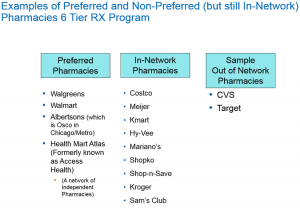

Beginning July 2019, pharmacy benefits will include both 5 and 6 tier benefit levels depending on the plan. The 2019 Mid-Market Brochure at the end of this blog will have the product chart showing which tier level each plan offers.

6 Tier Pharmacy Benefits

Generic drugs have different copays or coinsurance depending on if the member uses a preferred pharmacy or an in-network pharmacy.

Generic drugs have different copays or coinsurance depending on if the member uses a preferred pharmacy or an in-network pharmacy.

Brands drugs have different copays or coinsurance depending on if the member uses a preferred pharmacy or an in-network pharmacy.

Specialty drugs have different copays or coinsurance depending on if the member uses a preferred pharmacy or an in-network pharmacy.

Using a preferred pharmacy will offer the lowest cost to the member.

- For PPO plans, preferred pharmacies include Walgreens, Walmart, and Jewel Osco. CVS and some independent pharmacies are not included in the preferred network.

- For HMO plans CVS is included in the pharmacy network.

For enrolled members, the easiest way to find a preferred pharmacy, is to use the “Find a Pharmacy” link in Blue Access for Members (BAM). They will not have to pick a network as BAM is linked to the plan they are currently enrolled in.

The performance drug list is a closed drug list with most drug categories included. However, any drug not listed would not be covered.

5 Tier Pharmacy Benefits

Generally, this is a richer Rx plan, with lower copays and an open drug list allowing more options than the closed drug list in the 6 tier program.

Generic drugs have different copays or coinsurance depending on if the member uses a preferred pharmacy or an in-network pharmacy.

Brands drugs have different copays or coinsurance depending on if the member uses a preferred pharmacy or an in-network pharmacy.

The Advantage Network includes most national and regional chains as well as independent pharmacies. Walgreens is included but not CVS or Target.

There is an Enhanced Drug List which is an open drug list offering flexibility in the drugs available.

For both the 5 and 6 Tier pharmacy benefits

For members receiving infusion therapy, they can reduce their costs by using non-hospital facilities, like a doctor’s office, infusion center or home health care. Hospital settings have a $500 cost versus non-hospital settings which have a $50 cost. Infusion care therapy requires pre-authorization where members may be navigated toward a more cost effective site. This does not apply to HMO products, H.S.A. or Blue Options plans.

The out-of-network pharmacy cost has increased to 50% to encourage members to use in-network pharmacies.

Please note the newly added counties where this product will be available for groups effective 7.1.19.

.

Finally, BCBS is again offering First Year Renewal Rate Caps for new 51+ business with an effective date of July 1, 2019.

Who is eligible?

- Fully insured mid-market standard plans with July 1, 2019 effective dates.

- Mid-Market means groups with more than 50 total employees on business days in the previous calendar year and 150 or fewer enrolled lives.

- If your mid-market group currently has fewer than 51 enrolled employees, the renewal rate cap is also for them. It doesn’t apply to ACA small groups.

If your group is purchasing a plan for a July 1, 2019 effective date and wants the rate cap, please be sure to let your MIBS customer service representative know this when sending the submission paperwork.

Below is the link to the 2019 Mid-Market Group plan brochure showing all the plans being offered between 7/1/2019 and 6/30/2020.

Leave A Comment

You must be logged in to post a comment.